About Us

Commercial

Interiors

Our Tech

Brochure

Brochure

Call Us+91 7338325867

Brochure

Brochure

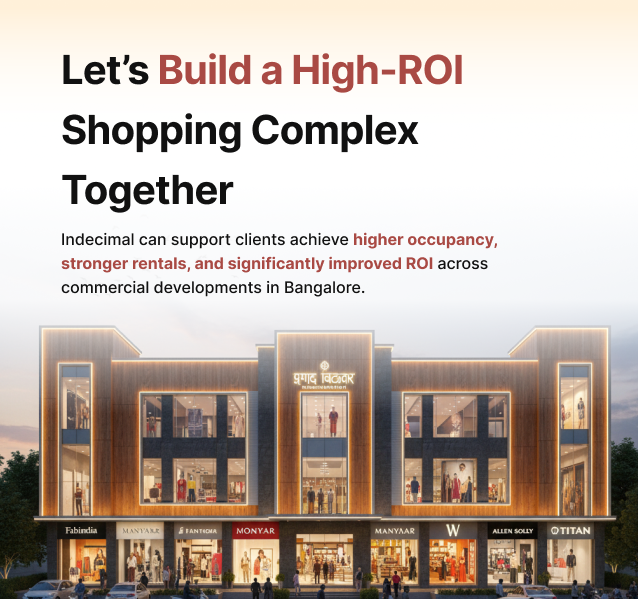

Identify pockets with strong footfall potential, residential density, and tenant demand.

Plan the ideal shop mix, unit sizing, rental strategy, and target tenants to maximise occupancy.

BBMP/BDA approvals, Fire NOC, Trade-related permissions—managed end-to-end.

BOQ, structural planning, MEP setup, and phase-wise construction budgeting.

Investor partnerships, funding options, and rental IRR modelling for better returns.

Rental demand analysis, ROI-focused lease structuring, tenant profiling, outreach & negotiation.